Sydney-based Diraq has recently secured AUD 120 million in funding, a development that reflects an increasing investor confidence in Australia’s technology sector. This substantial investment, sourced from a diverse group of venture capitalists and institutional investors, is expected to accelerate Diraq’s innovation and expansion initiatives. As the company aims to disrupt established technology paradigms, the implications of this funding extend beyond Diraq itself, potentially reshaping the broader tech landscape in Australia. The question remains, however, how this capital will influence not only Diraq’s trajectory but also the future of tech entrepreneurship in the region.

Overview of Diraq’s Funding

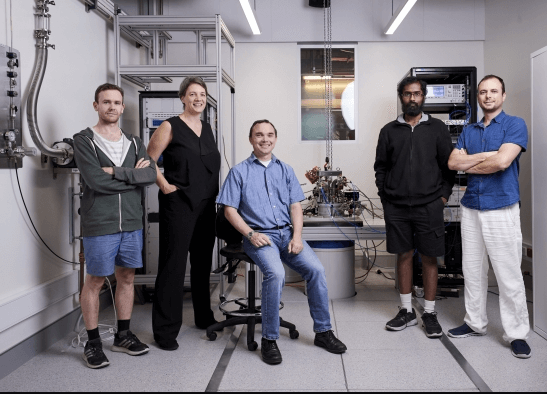

Diraq, a Sydney-based technology firm, has recently garnered significant attention following its successful funding round, which raised an impressive AUD 120 million.

This substantial capital influx reflects a robust investment strategy, attracting diverse funding sources, including venture capitalists and institutional investors.

Such financial backing not only bolsters Diraq’s growth prospects but also enhances its capacity to innovate and expand within the competitive tech landscape.

See also: Super Bowl Us Us Dec. Jan.Phuabloomberg

Impact on the Tech Industry

The recent AUD 120 million funding round for Diraq signals a notable shift in the Australian tech ecosystem, highlighting an increasing confidence among investors in the region’s potential for innovation.

This investment reflects evolving market trends, prompting startups to recalibrate their strategies.

As Diraq navigates the competitive landscape, its success may inspire further investments, ultimately reshaping Australia’s tech narrative and fostering a culture of entrepreneurship.

Future Prospects for Diraq

A promising trajectory lies ahead for Diraq, fueled by its recent funding success and the growing interest in the Australian tech landscape.

Diraq innovations are poised to disrupt conventional paradigms, while strategic Diraq partnerships can enhance collaborative efforts across industries.

As the company capitalizes on these opportunities, it is well-positioned to shape the future of technology, fostering an environment of creativity and freedom.

Conclusion

The recent influx of AUD 120 million into Diraq not only exemplifies a burgeoning optimism within the Australian tech ecosystem but also heralds a transformative era for the industry. This financial endorsement serves as a harbinger of innovation, potentially catalyzing a ripple effect of entrepreneurial aspirations across the region. As Diraq embarks on its ambitious journey, the anticipated advancements may very well redefine conventional technological paradigms, elevating Australia’s stature in the global tech arena.